History of Accounting and Business

Every development has its own historical background and the same historical background is also available with accounting. For understanding the theory of accounting it is important to learn the lesson from event, the occurrence of which leads to origination of a comprehensive accounting literature.

The history of accounting is as old as civilization, among the most important professions economic and cultural development, and fascinating. That’s right, fascinating! Accountants inventers writing, developed money and banking, innovated the double entry bookkeeping system that fueled that Italian Renaissance, were needed by industrial revolution inventors and entrepreneurs for survive helped develop the capital markets necessary for big business so essential for capitalism, turned into profession that brought credibility for complex business practices that sparked the economic boom of the 20th century, and are central to the information revolution that is now transforming the global economic twenty-first century accounting will resemble rocket science and will continue to be among the critic professions of the new century. Accountants have not excelled in public relations, but their story fascinating. And here it is.

There are no household names among the accounting innovators; in fact virtually no name survive before the Italian Renaissance. It took archaeologists to dig up the early history and scholars from many fields to demonstrate the importance to so many aspects of economic and cultural. This book cover the great events. From merchants and scribes long before writing and money, to today global information networks.

Vedic Resource:

Sufficient evidence exists to lead one to conclude that the art and practice of accounting, as a highly developed system, was in vogue in India even during thetimes of the Vedas, Sutras and the Upanishads…

The discussions in the Vedas about matters like the system of land tenure, currency, trade, various occupations as well as the general social and economic conditions in those times are indicative of the existence of a highly developed system of record keeping.

Looking back at Indian history, one finds that the art and practice of accounting were present in India even in Vedic times. The Rig Veda has references to accounting and commercial terms like kraya (sale), Vanij (merchant), sulka (price).

“Sale appears to have regularly consisted in barter in Rig veda; 10 cows are regarded as a possible price for an image of Indra to be used as a fetish. The haggling of the market was already familiar in the days of the Rig veda, and a characteristic hymn of the Atharvaveda, is directed to procuring success in trade. Price was referred Accounting Existed In Vedic India to as a Vasna and the Merchant, Vanij.

“An arithmetical progression of some interest is found in the Panchavimsa Brahmana, where occurs a ‘list of sacrificial gifts’ in which each successive figure doubles the amount of the preceding one…

Vikraya is found in the Atharvaveda and the Nirukta denoting ‘sale’. Sulka in the Rig veda clearly means ‘price’. In the Dharma Sutras it denotes a ‘tax’.

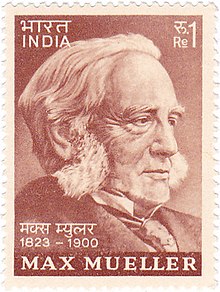

As Prof. Max Mueller observed.

“Whatever sphere of the human mind you may select for your study, whether be it language, or religion, or mythology, or philosophy, whether be it laws or customs, primitive art or primitive science, everywhere you have to go to India, whether you like it or not, because some of the most valuable & most instructive materials are treasured up in India, & in India only.”

Chanakya Theory

There is very clear evidence of the highly developed Hindu accounting tradition in “Arthashastra” written by Kautilya (also known as Chanakya and Vishnugupta) around 300 B.C. when literally translated, it means “Scripture of Wealth”. Though it focuses on creation and management of wealth, it is a master price covering a wide range of topics like statecraft, politics, warfare, law, accounting systems, taxation, fiscal policies, civil rules, internal and foreign trade etc. It contains particulars of business of keeping up accounts in the office of accountants. It contains matters which should be recorded, registers to be maintained, system of examination of accounts it also provided methods of detection of what is embezzled by government servants out of state-revenue; examination of the conduct of Government servants; the procedure of forming royal writs; the superintendent of the treasury; examination of gems that are to be entered into the treasury; and even details of punishments for default.

Luca Pacioli

Luca Pacioli (c.1447 – 1517) was the first person to publish detailed material on the double-entry system of accounting. He was an Italian mathematician and Franciscan friar who also collaborated with his friend Leonardo da Vinci (who also took maths lessons from Pacioli).

It is said that Luca Pacioli published works for the double entry accounting system based on procedures in use by Venetian merchants during the Italian Renaissance. Most of the accounting principles and cycles described by Luca are still in use to this very day. His documentation includes journals, ledgers, year-end closing dates, trial balances, cost accounting, accounting ethics, Rule 72 (developed 100 years earlier than Napier and Briggs), and extensive work on the double entry accounting system.

- Share: